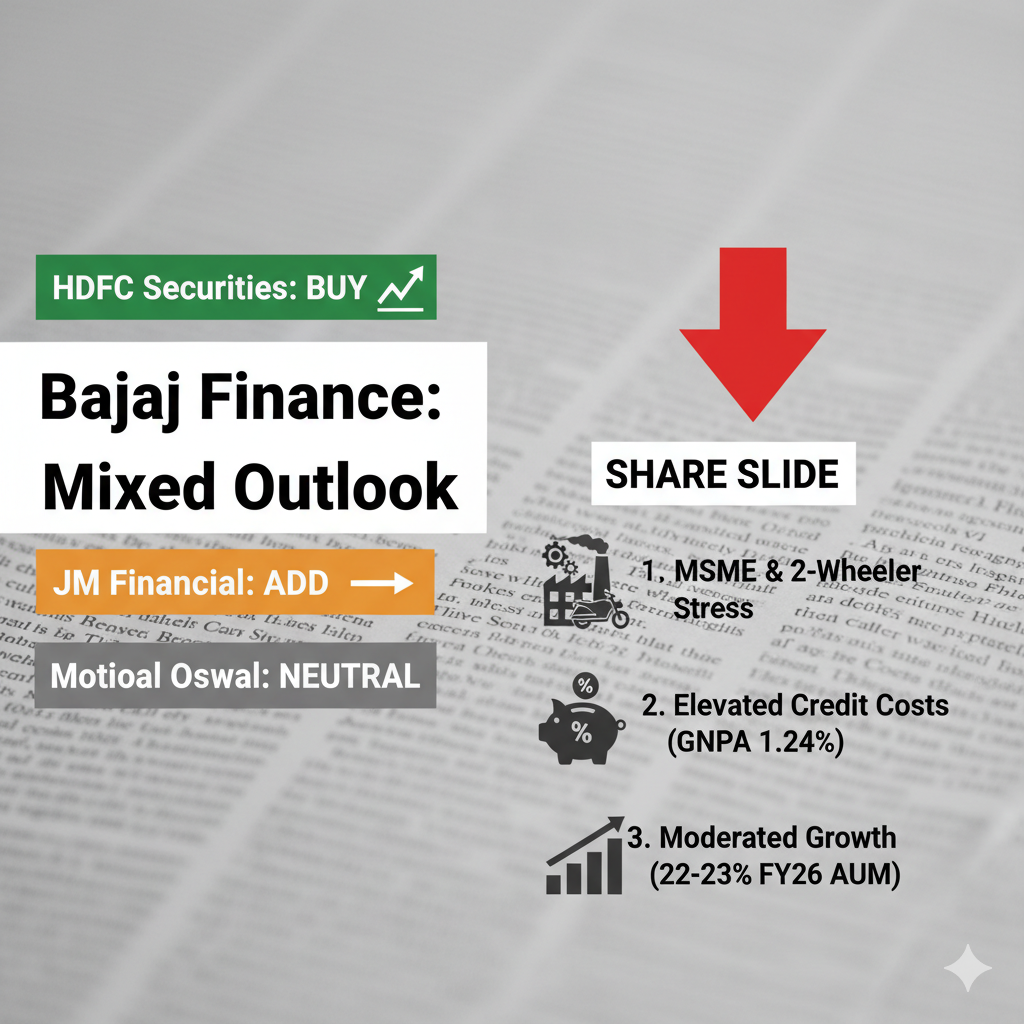

Buy or Sell Recommendation

The outlook is mixed, with different brokerages providing varied ratings:

- HDFC Securities maintained a Buy rating, citing strong operating efficiency despite near-term credit cost pressure.

- JM Financial downgraded its rating to Add (from Buy), noting that the quarter was steady on profit but weighed down by higher credit costs and MSME stress.

- Motilal Oswal reiterated a Neutral stance, stating that valuations remain expensive and they do not see near-term triggers for a re-rating.

3 Key Challenges Revealed

The article highlights three key areas of stress and concern that led to the sharp slide in shares:

- Stress in MSME and Captive Two-Wheeler Businesses: The company saw continued stress in its Micro, Small, and Medium Enterprises (MSME) and captive two-wheeler financing businesses, which contributed significantly to the rise in bad loans. The company had to cut unsecured MSME disbursals.

- Elevated Credit Costs and Deteriorating Asset Quality: Credit costs remained high at about 2% of Assets Under Management (AUM). Additionally, asset quality metrics deteriorated slightly, with Gross Stage 3 assets (GNPA) rising to 1.24% from 1.03% in the previous quarter, driven by the weaker portfolios.

- Moderation in Growth Forecast: Management gave a softer tone on growth, trimming its FY26 AUM growth forecast to 22–23%, compared with the earlier 24–25%. This slower growth guidance triggered the initial sell-off.